Content

- International Valuation Standards Council (IVSC)

- Strategies for Managing Research and Development Costs

- Educational material on applying IFRSs to climate-related matters updated

- What is a Good R&D Spending Ratio by Industry?

- Accounting for research and development costs: a comparison of U.S. and international standards

- Accounting Standards:

- It’s Time to Stop Treating R&D as a Discretionary Expenditure

- Initial recognition: computer software

This is not intended to be an exhaustive list, but it should illustrate the broad impact of the TCJA rule changes and emphasize the importance of making proper determinations. To sum it up, the notion that R&D is not a necessary expense must be revisited as digital companies play an increasingly important role in the economy and as digital innovation and technological advancement become the key drivers of a nation’s progress. Revenues for digital companies depend on the network of members and their engagement with the company’s platform.

Is R&D capitalized in US GAAP or IFRS?

Research and Development (R&D) Costs

US GAAP requires that all R&D is expensed, with specific exceptions for capitalized software costs and motion picture development. While IFRS also expenses research costs, IFRS allows the capitalization of development costs as long as certain criteria are met.

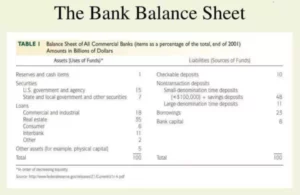

GAAP prefers not to address the uncertainty inherent in research and development programs but rather to focus on comparability of amounts spent (between years and between companies). GAAP to recognize assets when future benefits are clearly present as a reporting flaw that should accounting for research and development not be allowed. First, the amount spent on research and development each period is easy to determine and then compare with previous years and with other similar companies. Decision makers are quite interested in the amount invested in the search for new ideas and products.

International Valuation Standards Council (IVSC)

By using these technologies, teams can save time and money while still getting accurate results in a fraction of the time compared to traditional methods. Given the rate of technological advancement, particularly in countries like the U.S. and China, R&D is integral for companies to stay competitive and create products that are difficult for their competitors to replicate. To forecast R&D, the first step would be to calculate the historical R&D as a % of revenue for recent years, followed by the continuation of the trend to project future R&D spending or an average of the past couple of years. Considering how long-term the expected economic benefits could be, one could make the case that all R&D should instead be capitalized rather than treated as an expense. As you continue to iterate on your product, R&D also allows you to stay ahead of the competition, ultimately allowing you to sell more products and grow your business.

This could create a burden on certain taxpayers who have a short product development lifecycle and taxpayers who rely on significant participation from individuals outside of the U.S. Taxpayers may be receiving revenue from an R&E project that created a product, and yet they are still required to amortize the costs related to developing that product for a longer period. With the benefit being extended over a longer recovery period, the benefit could be impaired due to the time-value of money paired with inflation—depending on the magnitude and duration. According to the Financial Accounting Standards Board, or FASB, generally accepted accounting principles, or GAAP, require that most research and development costs be expensed in the current period. However, companies may capitalize some software research and development, or R&D, costs.

Strategies for Managing Research and Development Costs

These types of expenditures typically have long-term implications on future returns from any given product under development at any given point in time. Second, a large component of R&D costs for digital companies consists of employee costs for engineering, product management, and information technology personnel. Given the global quest for scientific talent and manpower, it is unlikely that digital companies would fire those employees in the short term with the hope of rehiring them in future.

Cash basis accounting only records transactions once money has been exchanged between parties involved in the transaction. (a) In R&D operations, personnel (labor) expenditures should be expensed as incurred. R&D spending is treated as an expense – i.e. expensed on the income statement on the date incurred – rather than as a long-term investment.

Educational material on applying IFRSs to climate-related matters updated

The ASC 730 approach will likely require the identification of additional Section 174 costs not captured in book R&D expense. Reid recognizes that corporate profits have been down lately and is hesitant to approve a project that will incur significant expenses that cannot be capitalized due to the requirements of the authoritative literature. He knows that if they hire an outside firm that does the work and obtains a patent for the process, Czeslaw Corporation can purchase the patent from the outside firm and record the expenditure as an asset.

- In addition, there may also be capital investments made in research facilities or intangible assets that need to be accounted for when calculating total R&D cost figures over periods longer than one year.

- Accounting for research and development (R & D) activities is an area of divergence between U.S.

- Under US GAAP, R&D costs within the scope of ASC 7301 are expensed as incurred.

- In the sectors mentioned above, R&D shapes the corporate strategy and is how companies provide differentiated offerings.

- As you continue to iterate on your product, R&D also allows you to stay ahead of the competition, ultimately allowing you to sell more products and grow your business.

- The starting point for companies applying IFRS is to differentiate between costs that are related to ‘research’ activities versus those related to ‘development’ activities.

CEO compensation plans and calculation of non-GAAP earnings, that often exclude stock-option expense, must reconsider those calculation methods when scientific manpower is paid mainly by stock options and is essential for the survival of the company. In terms of how research and development expenses are projected in financial models, R&D is typically tied to revenue. For example, a small business that develops new cosmetics might contract with an R&D company to assess the safety of a new product. Under GAAP, the company must expense the R&D cost and report it on the company’s current income statement.

This content supports Grant Thornton LLP’s marketing of professional services and is not written tax advice directed at the particular facts and circumstances of any person. If you are interested in the topics presented herein, we encourage you to contact us or an independent tax professional to discuss their potential application to your particular situation. Nothing herein shall be construed as imposing a limitation on any person from disclosing the tax treatment or tax structure of any matter addressed herein. The information contained herein is general in nature and is based on authorities that are subject to change. It is not, and should not be construed as, accounting, legal or tax advice provided by Grant Thornton LLP to the reader.

Before any new product is released into the marketplace, it goes through significant research and development phases, which include a product’s market opportunity, cost, and production timeline. After adequate research, a new product enters the development phase, where a company creates the product or service using the concept laid out during the research phase. On the other hand, applied research is a systematic study of application knowledge in the development of products or operations. But if you aren’t mindful of how much you’re spending, innovation can put you out of business before you even get off the ground. If you want to track the impact your R&D expenses have on your startup’s future, build a financial model in Finmark so you can forecast into the future. Taxpayers will be required to establish a methodology for identifying and tracking all R&E expenditures based on the new capitalization requirement under Section 174.

The general problem for companies is that future benefits from research and development are uncertain to be realized, and therefore R&D expenditures cannot be capitalized. Accounting standards require companies to expense all research and development expenditures as incurred. However, in the case of an M&A transaction, the R&D expenses of the target company may sometimes be capitalized as part of goodwill, because the acquirer can recognize the fair value of the R&D assets. The R&D costs are included in the company’s operating expenses and are usually reflected in its income statement. Even the IRS tax code’s tax credits for R&D expenditures are based on the idea that R&D is a non-essential expenditure and managers would avoid those investments without fiscal incentives.